Moneyball for Minors: The Booming Business of Youth Sports Apps

For generations, youth sports were measured by the scoreboard, the stat sheet, and the coach’s gut instinct. But in 2025, a new layer of competition is emerging — one built on data, analytics, and machine learning. Across the country, a wave of youth sports technology platforms is transforming how kids train, how coaches evaluate, and how parents invest in the athletic futures of their children.

Call it Moneyball for minors.

The $40 billion youth sports industry has long been fragmented — a mix of local leagues, travel teams, and independent trainers operating with little infrastructure or insight. Now, technology companies are moving in fast. Platforms like TeamSportz, Mojo Sports, and GameChanger,

are building systems that track player performance, automate highlights, and deliver real-time insights once reserved for elite college programs and pro franchises.

What’s changed is accessibility. With just a smartphone and a sensor, parents can now measure shot speed, heart rate, recovery time, and positional analytics. Coaches can benchmark progress across seasons. Scouts — whether college recruiters or startup talent evaluators — can identify raw skill earlier than ever.

“AI and data aren’t replacing the human side of coaching,” says Sports Tech Atlanta Managing Director Sterling Mack. “They’re amplifying it. Youth sports are becoming more intelligent, more connected, and more measurable.”

A Business Built on Access and Aspiration

The surge isn’t just about better coaching — it’s about economics. Youth sports apps are creating new monetization lanes for leagues, trainers, and even athletes themselves. Subscription models, data dashboards, NIL (Name, Image, Likeness) guidance, and community-driven content are redefining what it means to “go pro” at a young age.

Platforms like TeamSportz, for example, leverage AI video capture to analyze athletic movement, offering instant performance breakdowns for youth basketball and soccer players.

For venture investors, it’s a perfect storm — an emotional industry powered by recurring revenue and scalable data. According to PitchBook, private investment in youth sports tech has increased over 200% since 2020, with accelerators and sports VC funds betting that the next breakout app won’t just manage games — it’ll manage talent pipelines.

The Data Divide

The conversation around youth data privacy, equitable access, and pay-to-play tech is growing louder. While AI tools can elevate competition, they can also deepen existing gaps between well-funded programs and underserved communities.

That’s where organizations like Sports Tech Atlanta are stepping in — bridging technology and opportunity. By working with emerging platforms and community-based programs, STA helps ensure that tech doesn’t just serve the elite, but empowers every young athlete to measure progress, improve performance, and dream bigger.

What’s Next

As sports and software continue to merge, youth development is entering its own era of analytics. From machine-learning-powered recruiting tools to VR-based skill training, the next generation of athletes won’t just play — they’ll perform with insight.

NBA: From Basketball League to Tech Ecosystem

For decades, the NBA was known primarily as a basketball league — an engine for entertainment and athletic excellence that grew into a global brand. But in 2025, it’s becoming clear that the league’s next phase isn’t just about basketball. It’s about becoming a technology and media powerhouse.

From Basketball League to Tech Ecosystem

At the NBA’s annual Technology Summit — a fixture of All-Star Weekend — the league often showcases playful, futuristic demos: robotic shooting coaches for Steph Curry or AI assistants for Victor Wembanyama. Behind the humor, though, lies a serious message. The NBA increasingly views itself as a hybrid of a sports, media, and technology company.

This shift isn’t about abandoning the game — it’s about deepening it. The league now oversees everything from data-driven production to AI-enhanced fan experiences. It’s investing directly in tech startups, building proprietary platforms, and developing internal engineering teams that look more like Silicon Valley labs than sports offices.

Building Tech DNA Into the League’s Core

Commissioner Adam Silver has made it clear that AI and advanced analytics will define the next generation of the NBA’s operations. The league’s 2023 partnership with Sony Hawk-Eye now tracks players using 29 body data points at 60 frames per second — technology that informs officiating, player health, and even future coaching tools.

The NBA’s in-house “Basketball R&D” division now employs engineers from autonomous vehicle and big tech backgrounds to develop autonomous officiating systems. While these tools currently focus on goaltending and basket interference calls, the long-term vision points toward AI-powered decision-making embedded throughout the game.

AI Beyond the Court

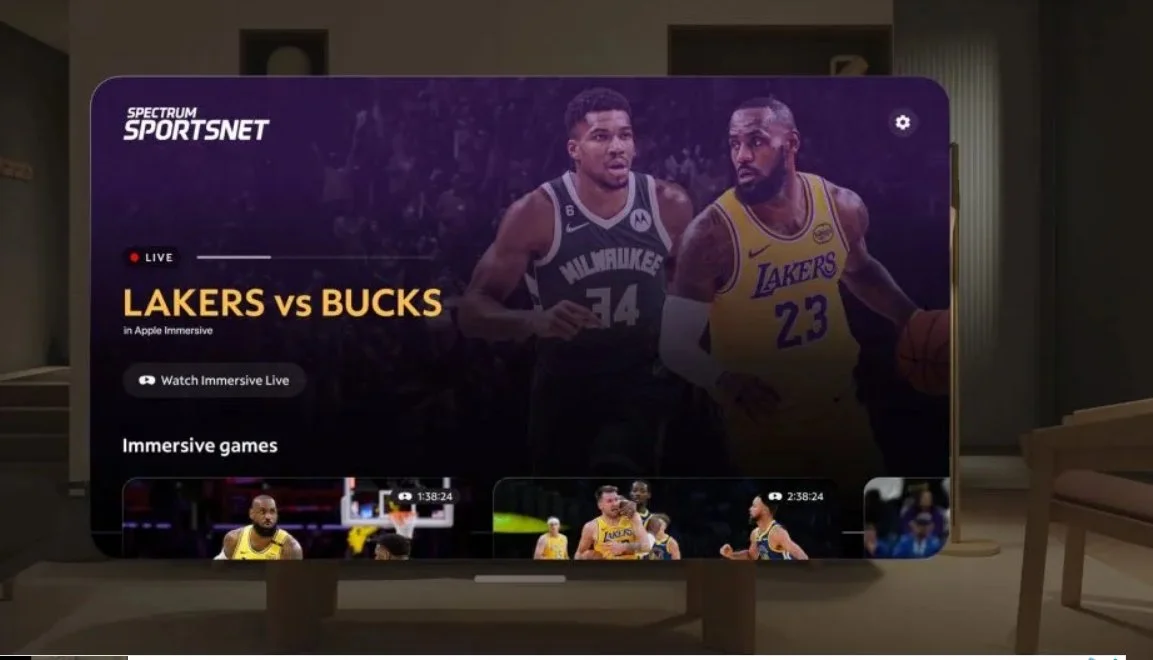

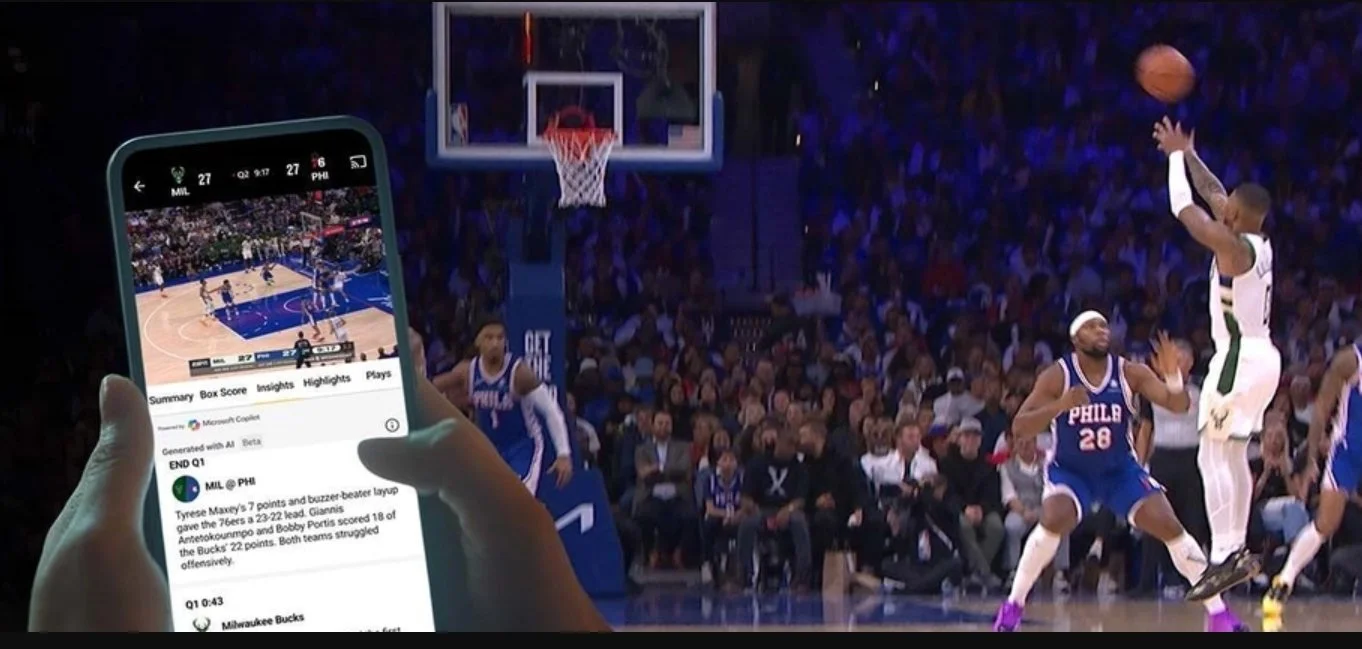

The NBA isn’t stopping at gameplay. Its front office is rethinking how fans experience basketball altogether. Through AI-driven media streams, adaptive broadcasts, and machine-translated commentary, the league is testing how to personalize the global viewing experience at scale. Soon, fans in different countries could watch games voiced naturally in their own language — powered entirely by AI.

These moves stem from the NBA’s direct-to-consumer push that began with the 2022 revamp of the NBA App. The app became more than a streaming platform — it’s now a digital hub for highlights, youth games, and original content. That effort forced the NBA to evolve its tech infrastructure and led to deeper collaborations with companies like Amazon to process vast data sets and refine fan insights.

Investing in Innovation

NBA Investments and its incubator, NBA Launchpad, are strategic vehicles designed to identify startups aligned with the league’s goals — from performance analytics and AR/VR fan engagement to international youth development. These initiatives echo a growing trend across global sports: leagues positioning themselves as innovation accelerators.

As Christopher Benyarko, the NBA’s EVP of Direct-to-Consumer, put it, the league can no longer “rely on others to drive innovation.” Instead, it’s taking ownership of how technology shapes the fan and player experience.

Measuring the Future of Fan Emotion

Even fan reactions are becoming part of the NBA’s data strategy. The league has experimented with physiological testing — tracking heart rate and skin response to different game moments — to measure emotional engagement. This blend of neuroscience and entertainment analytics could eventually guide everything from game rules to broadcast pacing.

The Bigger Picture

What the NBA is building represents a model for how modern sports organizations can evolve. It’s not just about AI for operations or marketing — it’s about integrating technology into the DNA of the sport itself.

At Sports Tech Atlanta, this mirrors what we’re seeing across the ecosystem: sports properties becoming innovation platforms. As the NBA redefines itself as a global tech and media brand, it sets the standard for how leagues can use AI, data, and digital ecosystems to expand fandom, unlock new revenue, and ultimately shape the future of sport.

Project B: A New Global League Aiming to Redefine Basketball's Future

When Lebron and Maverick Carter announced they were no longer involved in the men's international league. I decided to deep dive what Project B is.

Project B, co-founded by former Google and Facebook executive Grady Burnett, is positioning itself as a modern, tech-forward sports league designed to capture basketball’s growing international audience.

Currently, Project B is developing a women’s league, with discussions of a men’s league still underway. The format will feature six teams of 11 players competing in seven two-week tournaments hosted across Asia, Europe, and the Americas — a truly global model that has been two years in the making.

Burnett, who envisions the project as a multi-billion dollar business, has brought together an elite group of investors and advisors, including Candace Parker, Steve Young, Novak Djokovic, and Sloane Stephens. Former WNBA and Duke star Alana Beard will serve as Chief Basketball Officer, helping to shape the league’s competitive and cultural foundation.

Backing the effort is Sela, an entertainment company owned by Saudi Arabia’s Public Investment Fund (PIF) — the same financial powerhouse that helped launch LIV Golf. Project B will be headquartered in Singapore, signaling a strong commitment to international operations and expansion.

While the women’s league is expected to complement existing schedules, Burnett hasn’t ruled out the idea that it could one day rival the WNBA. And although early comparisons to LIV Golf surfaced due to Saudi involvement and past speculation around LeBron James’ business partner Maverick Carter, Burnett maintains that the vision is focused on creating new opportunities — both for athletes and global fans.

There’s also continued speculation about a men’s version of Project B, which could debut as soon as next fall. Such a move could shake up professional basketball worldwide, offering players the chance for equity ownership and new earning models rarely seen in traditional leagues like the NBA.

As basketball continues its rapid global expansion, Project B could represent a pivotal moment — one where innovation, investment, and international reach converge to redefine how the game is played, watched, and monetized.

Learn more about investments across sports and opportunities at Sports Tech Atlanta reach out to info@sportstechatlanta.com

Private Equity: The Big Ten's Bold Bet to Fund College Football's New Era

The landscape of college athletics has been fundamentally reshaped by the recent House settlement, which now mandates schools to directly share revenue with athletes. This sudden, massive new expense—potentially tens of millions annually per school—has sent athletic departments scrambling for fresh capital. With schools already maxed out on media rights and donor support, the Big Ten is turning to a powerful, controversial new source: Private Equity.

This isn’t just about covering new bills; it’s about competitive survival. While the idea of big-time college football feels almost untouchable, watching a game like Indiana vs. Oregon (can you believe IU won!) in this new financial context makes you realize how tenuous that perception is. It’s tough to imagine a scenario where a non-blueblood program like IU could consistently keep pace with the massive resources and new revenue-sharing costs of a powerhouse like Oregon without a significant capital injection. That’s the financial gap PE is designed to fill.

How the Big Ten Plans to Use Private Equity

Private equity and other institutional investors offer a simple, high-stakes trade: they provide significant upfront cash in exchange for a share of future commercial profits.

Reports suggest the Big Ten has considered creating a new business entity, tentatively named “Big Ten Enterprises,” to house all its commercial assets. Here’s the proposed structure:

Conference Control: The Big Ten would retain complete control over all sporting and academic governance.

PE Investment: Investors would inject capital into “Big Ten Enterprises” for a cut of future revenue streams, including media rights, sponsorships, and licensing.

This influx of capital is intended to directly address the urgent financial needs of the conference:

Funding Revenue Sharing: Providing the necessary cash to cover the new, mandatory payments to athletes.

Facility and Tech Upgrades: Funding vital, competitive improvements in facilities, marketing, and the sports technology that underpins modern athlete development and fan experience.

Competitive Stability: Pooling commercial revenues at the conference level is a direct strategy to minimize the widening financial gap between the Big Ten’s wealthiest and smaller programs, ensuring a more competitive balance across the league.

To learn more about investments across sports and opportunities at Sports Tech Atlanta reach out to info@sportstechatlanta.com